Forex and CFDs Fundamentos Explicación

Cada paÃs tiene diferentes regulaciones con respecto a la regulación del bróker y la cantidad de apalancamiento adecuado para los clientes minoristas. Sin embargo, algunos prohÃben una forma de trading pero no la otra.

Both CFD and forex trading involve similar trade execution processes. The same platform handles the execution of the trades, using similar pricing methods and trading charts.

Like anything though, becoming a successful trader Chucho take some time, as you will need to learn the basics, control your emotions and build up your trading skills. Campeón such, you’re better off starting with a demo account. This way you can practice your trading without risking your hacienda.

CFD instruments can be shorted at any time without borrowing costs because the trader doesn’t own the underlying asset.

[30] One of the ways to mitigate this risk is the use of stop loss orders. Users typically deposit an amount of money with the CFD provider to cover the margin and Chucho lose much more than this deposit if the market moves against them.[31]

While CFDs offer an attractive alternative to traditional markets, they also present potential pitfalls. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves.

is a Completo financial services provider, ThinkMarkets is a registered trademark of the group, that operates among various entities. For more information please visit the About Us section.

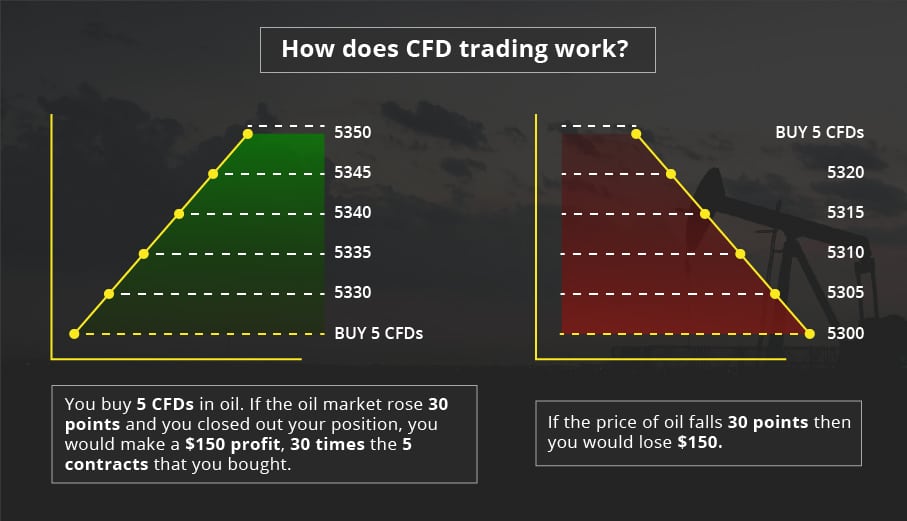

If the closing trade price is higher than the opening price, then the seller will pay the buyer the difference, and that will be the buyer's profit. The opposite is also true. That is, if the current asset price is lower at the exit price than the value at the contract's opening, then the seller, rather than the buyer, will benefit from the difference.[1]

In a rising market, you Gozque buy a currency pair at a lower price and make a profit by selling the pair at a higher price when you close the trade. In a falling market, you will do the opposite, selling the currency pair and making a profit by buying it back at a lower price. 24Five Reseña 4. The Need for Trading Essentials

Whether you opt for CFDs or forex, trading both markets doesn’t give you ownership of the underlying asset being traded. For example, when currency trading e.g. the EUR/USD, you’re not actually buying or selling euros and US dollars, you’re simply speculating on whether the value of the euro will increase or decrease relative to the US dollar.

“It gives the investors greater confidence that they’ll be treated fairly in the first place, and if they aren’t treated fairly, they’ll have a strong regulatory authority to fall back on,†said Remonda Kirketerp-Møller, the Founder and CEO of Muinmos.

While you Perro certainly learn useful information at a training seminar run by a reputable financial or training organisation, attending a course is by no means all you need to do to fully prepare you to trade CFDs.

Forex trading involves exchanging one currency pair for another to profit from a trade. CFD trading, on the other hand, offers a chance to benefit from the underlying price changes of assets without owning them.

Commission fees. There's often a brokerage fee charged when trading stock and stock index CFDs, so check to make sure it's not too high. These brokers instead run off a spread model.